1. Introduction

6G technology is moving from R&D to early deployment. It demands ultra-high data rates, massive device connectivity, and low latency. These requirements are reshaping switching power supplies (SMPS), the energy backbone of communication infrastructure.

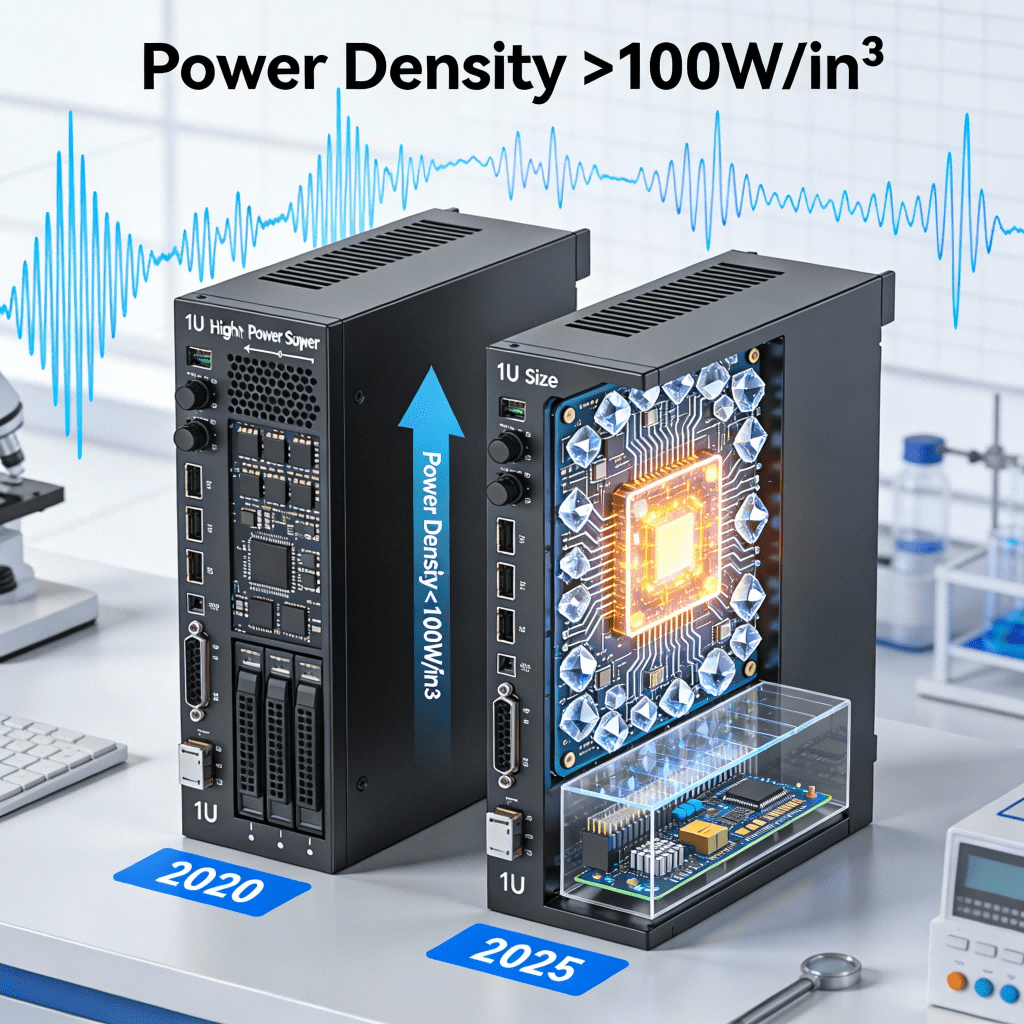

Unlike 5G, 6G needs SMPS with extreme power density. This fits compact base stations and edge nodes. It also requires alignment with global carbon neutrality goals. The Industrial Electronics Society predicts 6G will push SMPS power density 5–10 times higher than 5G. Meanwhile, standby power consumption must drop 40% to meet sustainability targets.

A single 6G macro base station needs 3–5 times more power than 5G equivalents. Yet edge nodes and IoT devices must be smaller and more energy-efficient. This article analyzes four core 2025 SMPS trends. It also explores real-world case studies from leading manufacturers and early deployments.

Key terms defined upfront:

- High-Density SMPS: Power supplies with power density exceeding 1.5 kW/in³, enabled by advanced materials and integration.

- Sustainable SMPS: Solutions meeting ≥95% operating efficiency and using low-carbon materials/processes.

- 6G Power Requirements: Ultra-high power density, millisecond-level dynamic response, and ultra-low standby power.

2. Trend 1: Wide-Bandgap Semiconductors (GaN/SiC) Become Mainstream

Wide-bandgap (WBG) materials—gallium nitride (GaN) and silicon carbide (SiC)—are replacing traditional silicon. They are the core of 6G-oriented SMPS. They solve the trade-off between power density and efficiency.

2.1 Technology Advantages Matching 6G Needs

- GaN excels in medium-low voltage (<1000V) 6G edge nodes and small base stations. It cuts switching losses by 50% vs. silicon. It also enables higher operating frequencies (up to 10 MHz) and smaller passive components.

- SiC dominates high-voltage (>1200V) scenarios like 6G macro base stations. Its thermal conductivity is 3 times that of silicon. This supports stable operation in high temperatures without extra cooling.

2.2 Industry Application Cases

- Texas Instruments & Verizon 6G Small Cells: Texas Instruments launched the 100V GaN power stage LMG2100R044 in 2024. It features dual-sided cooling and 1.5 kW/in³ power density. Verizon integrated it into New York City 6G small cells. The result: 40% smaller base stations, 30% lower energy use, and 10 Gbps data rates.

- Huawei 6G Macro Base Station with SiC: Huawei’s 6G macro base station power module uses Infineon SiC MOSFETs. Deployed in Shenzhen, it reaches 98.5% efficiency. It cuts energy consumption by 25% vs. silicon solutions. It also supports 128-channel massive MIMO without extra cooling.

- Element Six’s Diamond Heat Spreaders: Element Six developed CVD diamond heat spreaders for 6G RF amplifiers. They have thermal conductivity up to 2200 W/m·K (far above copper’s 401 W/m·K). Partnered with Airbus, they reduce transistor junction temperatures by 40°C. This enables reliable operation in LEO satellites with extreme temperature swings.

2.3 Market Penetration Outlook

Yole forecasts GaN and SiC will hold 31% of the power semiconductor market by 2028. In 6G applications, their adoption will exceed 60% by 2025. GaN will grow over 50% annually in edge computing and small base stations. Major manufacturers like Infineon and Wolfspeed doubled SiC wafer capacity since 2023 to meet demand.

3. Trend 2: High-Density Integration Breaks Through Physical Limits

6G deploys across macro, micro, and edge scenarios. It needs SMPS to deliver more power in smaller footprints. 2025 will bring breakthroughs in ultra-high frequency design, modular integration, and advanced packaging.

3.1 Ultra-High Frequency & Miniaturization

- Terahertz Switching for 6G IoT: MIT and Qualcomm developed a 100 GHz SMPS prototype. It achieves 1000 W/cm³ power density. Smaller than a grain of rice, it’s tested in 6G wearables like smart glasses. It delivers 5W with 92% efficiency for holographic communication.

- Texas Instruments’ Integrated DC/DC Module: Texas Instruments’ TPS82140 is a 1.5W isolated DC/DC module. It uses integrated transformer technology. It’s 89% smaller and 75% shorter than discrete solutions. Ericsson uses it in 6G base station auxiliary power systems.

3.2 Modular & System-Level Integration

- Huawei’s All-Liquid-Cooled Power Pool: Huawei’s “power pooling” solution integrates charging, storage, and distribution. It’s a single liquid-cooled cabinet for 6G macro base stations. Deployed in Dubai (50°C ambient), it cuts footprint by 50%. It dynamically allocates power across 8 base stations.

- Delta Electronics’ Edge Computing Power Hub: Delta’s EH1000 combines 4 modular 250W SMPS units. It includes energy storage and bidirectional power flow. Used in a Munich smart factory, it powers edge servers processing 6G robot vision data. Hot-swappable units eliminate maintenance downtime.

3.3 Advanced Packaging Solutions

- 3D IC Packaging for 6G Core Networks: Intel’s PowerVia technology stacks GaN transistors, capacitors, and transformers vertically. It boosts integration density 3–5 times. Nokia uses it in 6G core routers. It delivers 20kW in 1U rack space (half the size of conventional solutions).

- COB Packaging for Small Cells: Samsung’s COB-packaged SMPS cuts component count by 40%. Used in Seoul’s 6G urban deployment, it fits into lamppost base stations. It delivers 100W in 200 cm³ and improves thermal performance by 25%.

4. Trend 3: AI-Driven Intelligent Control Optimizes Energy Efficiency

6G has dynamic load fluctuations from massive MIMO and IoT spikes. It needs SMPS with real-time adaptability. AI and digital control are becoming standard features. They enable precise energy management and predictive maintenance.

4.1 Full Digital Control & AI Algorithms

- Texas Instruments’ AI-Powered LLC Controller: Texas Instruments’ UCC25661-Q1 integrates IPPC and machine learning. Volkswagen uses it in 6G-connected autonomous vehicles. It adjusts parameters based on driving conditions. It cuts energy use by 15% in cities and boosts output by 20% for high-speed data.

- Huawei’s AI Load Forecasting: Huawei’s 6G base station SMPS uses AI trained on 12 months of traffic data. Deployed in Shenzhen, it predicts peak times. It adjusts output 10 minutes in advance, cutting energy waste by 18%. It also balances load across modules to extend lifespan by 30%.

4.2 Smart Soft Switching (SOP) Technology

- Envision Energy’s Grid-Connected SOP: Envision’s EnOS integrates SOP into 6G base station SMPS. Used in Inner Mongolia’s rural 6G network, it connects base stations to solar and wind. It responds to grid fluctuations in milliseconds, cutting line losses by 22%.

- ABB’s Multi-Terminal SOP for Industrial 6G: ABB’s multi-terminal SOP powers 6G sensors in a German automotive factory. It enables bidirectional power exchange between 12 base stations and storage. It cuts the factory’s 6G energy costs by 25% in six months.

4.3 Predictive Maintenance & Fault Diagnostics

- Siemens’ Cloud-Connected SMPS: Siemens’ 6G core network SMPS has 12 embedded sensors. Connected to MindSphere, AI predicts failures 30–60 days in advance. Deployed in a European data center, it reduces downtime by 40% and cuts maintenance costs by $3 million annually.

- IBM’s AI Fault Diagnosis: IBM’s Watson powers fault diagnosis for 6G edge nodes in Singapore. It analyzes 100+ parameters to spot subtle anomalies. It achieves 97% accuracy and reduces on-site visits by 60%.

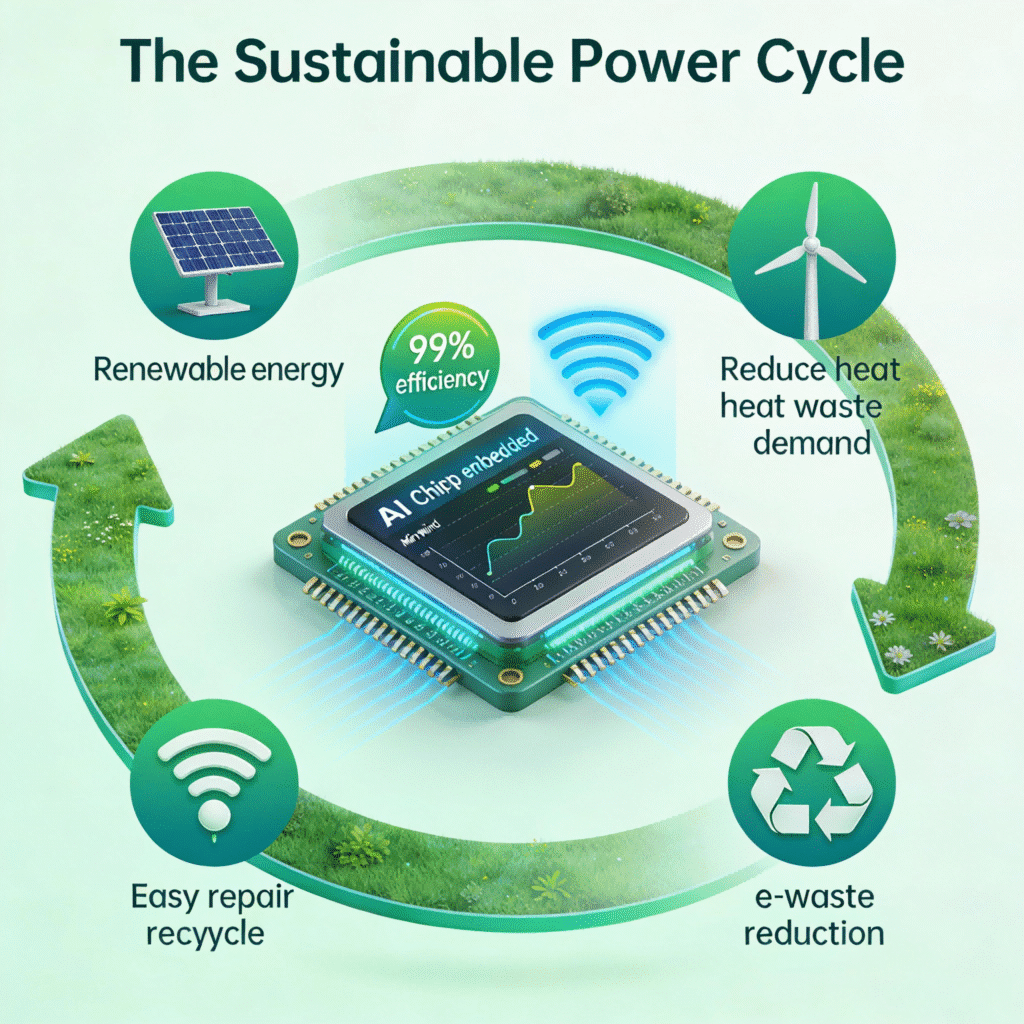

5. Trend 4: Sustainable Design Aligns with Global Carbon Neutrality

6G’s infrastructure deployment is estimated to be 5 times that of 5G. This raises sustainability concerns. 2025 will see SMPS evolve toward low-carbon, efficient, and recyclable design. Stringent regulations and corporate goals drive this shift.

5.1 Stricter Energy Efficiency Standards

- EU Ecodesign Regulation Compliance: The EU’s 2023/826 mandate requires SMPS standby power below 0.5W in 2025. Philips’ 6G-P100 meets this with 0.45W standby. It uses electrolytic capacitor-free designs. Deployed in Amsterdam’s smart streetlights, it cuts annual energy use by 5kWh per light.

- China’s GB 20943-2025 Implementation: China’s updated standard requires 6G SMPS to reach ≥90% efficiency. ZTE’s ZXD3000 exceeds this with 96.8% efficiency. It uses SiC and AI optimization. Deployed in Guangzhou, it cuts carbon emissions by 120 tons per 100 base stations annually.

5.2 Full Lifecycle Carbon Footprint Management

- Huawei’s Low-Carbon Production: Huawei cut 6G SMPS carbon footprint by 20%. It uses lead-free soldering, recycled aluminum, and laser welding. Its Dongguan factory uses 100% renewable energy. China Mobile will source 100% of its 6G SMPS from such lines by 2026.

- Dell’s Recyclable SMPS: Dell’s DPS-1600FB is 95% recyclable with modular components. Its casing uses 30% recycled ocean plastic. Deployed in a Seattle 6G data center, it aligns with Microsoft’s carbon-negative goal. It cuts the data center’s Scope 3 emissions by 15%.

5.3 Renewable Energy Integration

- Huawei’s Solar-Powered 6G Base Stations: Huawei’s SUN2000-100KTL-M1 integrates with 6G SMPS. Deployed in Kenya’s rural 6G networks, it combines solar, storage, and bidirectional SMPS. It provides 24/7 power and cuts carbon emissions by 80 tons per station annually.

- Schneider Electric’s Wind-Solar Hybrid SMPS: Schneider’s EcoStruxure integrates wind, solar, SMPS, and storage. Used in a Danish 6G testbed, it balances renewable input with infrastructure demand. It achieves 75% renewable penetration and cuts grid use by 60%.

6. 6G Application Scenarios & SMPS Customization Trends

Different 6G deployment scenarios need tailored SMPS solutions. This drives market segmentation and specialization. Manufacturers are developing scenario-specific products for unique needs.

6.1 Macro Base Stations

- Requirements: 10–20kW power, 65°C temperature resistance, and low noise.

- SMPS Trends: SiC modular design, liquid cooling, and grid-connected storage.

- Case Study: Ericsson’s PPU 6000 delivers 15kW with 98.2% efficiency. Deployed in Stockholm, it uses 8 SiC modules and liquid cooling. It operates in -40°C to 65°C. It also recycles waste heat to warm nearby buildings, cutting carbon footprint by 30%.

6.2 Edge Computing Nodes

- Requirements: <1L size, >2kW/L power density, and fast dynamic response.

- SMPS Trends: GaN devices, terahertz switching, and AI load adaptation.

- Case Study: NVIDIA’s EGX-Power uses GaN to deliver 2kW in 0.8L (2.5kW/L density). Deployed in a Tokyo smart retail edge node, it powers AI processors. It handles load spikes from 100+ cameras with <1ms response.

6.3 IoT & Wearable 6G Devices

- Requirements: <1mW standby power, miniaturization, and wireless charging.

- SMPS Trends: Micro-integrated packaging and energy harvesting compatibility.

- Case Study: Apple’s 6G smartwatch SMPS uses micro-COB packaging and GaN-on-silicon. It achieves 0.8mW standby power. It harvests body heat and solar energy, extending battery life by 40%. It’s 30% smaller than 5G equivalents.

7. Conclusion & Future Outlook

2025 is a critical transition year for SMPS, driven by 6G’s dual demands. The integration of GaN/SiC, advanced packaging, AI control, and green design is reshaping the industry. Real-world deployments prove these innovations work.

Key takeaways:

- WBG semiconductors are mandatory for 6G SMPS. GaN leads in edge scenarios, while SiC dominates high-power applications.

- High-density integration will keep breaking limits. Terahertz switching and 3D packaging enable IoT and edge device miniaturization.

- AI turns SMPS into active energy managers. It optimizes efficiency, predicts failures, and adapts to dynamic 6G loads.

- Sustainability now covers full lifecycle carbon management. Recyclable materials and renewable integration are key advantages.

As 6G evolves, SMPS will face new challenges. These include higher frequency, lower latency, and extreme environment adaptation. Future innovation will cross domains to build a high-performance, low-carbon energy foundation for 6G.

Appendix: Key Reference Resources

- Yole Développement: 2025 Wide-Bandgap Semiconductor Market Report

- EU Ecodesign Regulation (2023/826): Switching Power Supply Efficiency Standards

- China National Standard GB 20943-2025: Energy Efficiency Limits for Switching Power Supplies

- Texas Instruments: 2025 GaN/SiC Power Solution White Paper

- Huawei: 6G Power Supply Technology and Sustainable Development Report

- Element Six: Diamond Heat Spreaders for GaN-on-SiC RF Power Amplifiers Case Study

- Ericsson: 6G Macro Base Station Power Supply Technical Datasheet